If you’re exploring how to use life insurance as a wealth-building and insurance investment tool, you’re not alone. Savvy investors are increasingly turning to permanent life solutions like whole life insurance, universal life, and even variable life, not just for protection, but for creating tax-advantaged cash value, accessing insurance cash, and generating future retirement income. These policies offer a unique combination of security and liquidity that complements traditional financial goals, but not all policies are built the same.

Let’s break it down piece by piece so you can identify which type of policy is most suitable for your long-term investment strategy.

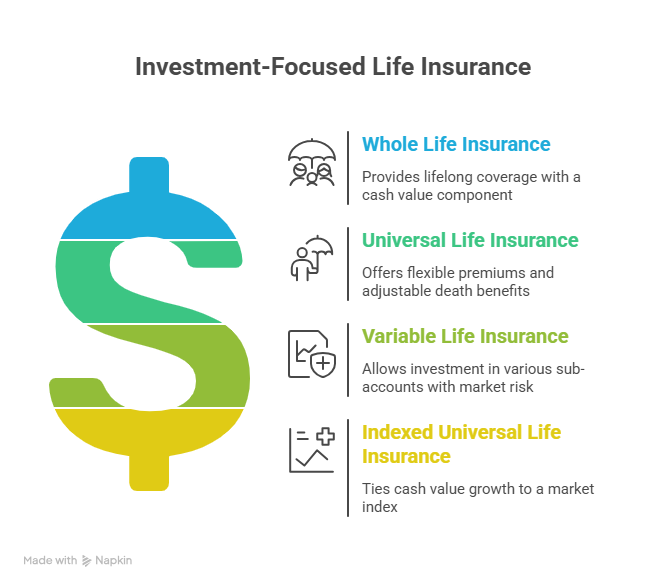

Types of Life Insurance Commonly Used for Investment

When it comes to using life insurance for investment purposes, permanent life insurance policies—not term—are the vehicles to consider. These policies build cash value that can be accessed during your lifetime. The three most commonly used types of life insurance are:

Whole Life Insurance

Whole Life Insurance offers guaranteed fixed interest growth, the potential for annual dividends, and level premiums that never increase.

Indexed Universal Life (IUL) Insurance

Indexed Universal Life (IUL) Insurance provides flexible premiums and death benefits, with cash value growth tied to a stock market index (like the S&P 500). It includes a floor that protects against market losses.

Variable Universal Life (VUL) Insurance

Variable Universal Life (VUL) Insurance allows you to allocate cash value into market subaccounts similar to mutual funds, giving it high growth potential—but with increased risk and volatility.

Each of these policies functions differently, but they all combine insurance protection with a savings or investment component. Whole Life is typically chosen for its reliability and structure, IUL offers market-linked upside without direct exposure, and VUL is best suited for experienced investors who want to manage their market exposure within the policy.

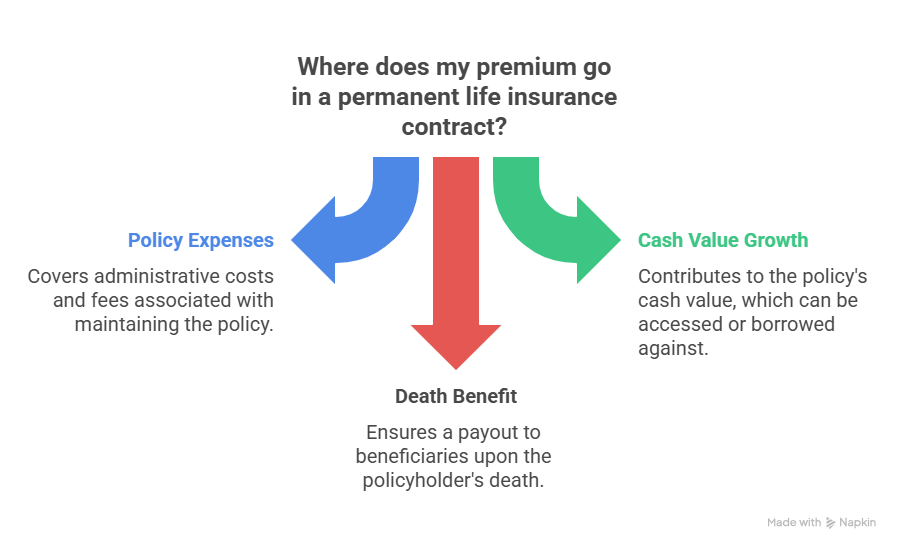

Where Does Your Premium Go? Policy Components Explained

To evaluate a policy’s investment potential, you first need to understand where your premium actually goes. Permanent life insurance policies divide your payments into three core components:

- Cost of Insurance (COI) is the portion that pays for the death benefit coverage. This cost increases over time as you age, and it’s the non-negotiable cost of maintaining the policy.

- Administrative & Policy Fees cover things like underwriting, contract maintenance, and any riders you’ve added. These costs are usually higher in the early years of the policy.

- Cash Value Contribution is what’s left after fees and insurance costs. This is the money that accumulates inside your policy, earning interest or market-linked returns depending on the policy type. You can borrow against this value, withdraw from it, or use it for future premiums.

The balance between these three components determines how effective your policy is as an investment vehicle. In low-premium structures, much of your money goes toward COI and fees. But with careful planning, you can design the policy to minimize insurance costs and maximize the cash value—a tactic known as overfunding.

How Cash Value Growth Works

When evaluating a life insurance policy as an investment vehicle, it’s crucial to understand how the cash value grows inside the contract. Each policy type uses a different crediting method, which impacts how much (and how predictably) your money compounds over time.

- Whole Life: Grows at a fixed interest rate, often with non-guaranteed dividends paid by the insurer annually.

- IUL: Cash value is linked to a market index, like the S&P 500. Growth is capped on the upside and floored on the downside (typically 0%), offering market exposure without risk of loss.

- VUL: Functions like a brokerage account within your policy. Gains and losses are fully market-driven based on the subaccounts you choose.

To illustrate how this might play out, here’s a simplified example of year-over-year growth inside each policy type (assuming consistent funding):

| Year | Whole Life (4.5%) | IUL (Avg 7%, Cap 10%) | VUL (Aggressive, Avg 9%) |

|---|---|---|---|

| 1 | $9,450 | $9,700 | $9,900 |

| 5 | $56,600 | $60,200 | $62,900 |

| 10 | $123,000 | $135,400 | $142,300 |

| 20 | $287,000 | $325,100 | $352,700 |

Note: This table is illustrative only and does not reflect guaranteed or actual returns.

These projections are for illustrative purposes only and do not represent actual policy guarantees or investment outcomes.

The takeaway? Whole life offers steady and predictable growth; IUL offers balance, moderate upside with no risk of loss; VUL offers the highest upside and the greatest risk. Your choice depends on your risk tolerance, time horizon, and whether you value guarantees or growth.

Life Insurance vs. Traditional Investment Options

Life insurance is not a replacement for retirement accounts like a 401(k) or Roth IRA, but it plays a unique and strategic role when used alongside them. Here’s a quick comparison:

| Feature | Whole Life / IUL / VUL | 401(k) | Roth IRA | Brokerage Account |

|---|---|---|---|---|

| Tax-deferred growth | ✅ Yes | ✅ Yes | ✅ Yes | ❌ No |

| Tax-free withdrawals | ✅ If structured properly | ❌ Taxable in retirement | ✅ Yes (if qualified) | ❌ Capital gains tax applies |

| Early access without penalties | ✅ Policy loans any time | ❌ Penalties before 59½ | ❌ Penalties before 59½ | ✅ Yes, but taxed |

| Contribution limits | ❌ Only limited by MEC rules | ✅ $23,000/year (2025 limit) | ✅ $7,000/year (2025 limit) | ❌ No limits |

| Market risk exposure | Optional (based on policy type) | ✅ Yes | ✅ Yes | ✅ Yes |

| Use as collateral | ✅ Yes (policy loans) | ❌ No | ❌ No | ✅ Sometimes |

| Requires health qualification | ✅ Yes | ❌ No | ❌ No | ❌ No |

The strategic benefit of life insurance lies in its liquidity, tax advantages, and flexibility. It can act as a private reserve of capital to fund business ventures, real estate, or emergency needs, without penalties or taxable events. While it’s not a high-growth investment like aggressive equities, it fills a critical role in risk management, legacy planning, and cash flow strategy.

Overfunding & Infinite Banking: Strategies for Cash Value Maximization

Some investors go a step further in their insurance investment and use advanced strategies to turn life insurance into a personal financial system. The most popular of these are overfunding and the Infinite Banking Concept (IBC).

Overfunding is the act of intentionally paying more than the required minimum premium—up to IRS-allowed limits—so that the majority of your contribution goes directly into the cash value. This not only speeds up the accumulation process but also builds a pool of tax-advantaged capital that can be accessed for virtually any purpose.

The Infinite Banking Concept builds on overfunding by treating your policy like a private lending system.

Here’s how it works:

- You overfund the policy,

- allow the cash value to grow, and then

- borrow against it to fund purchases like real estate, business investments, or major life expenses.

Meanwhile, the full cash value continues to compound as if the loan were never taken out. You repay the policy loan—effectively paying yourself back with interest.

This approach appeals to investors who want control over their capital, tax efficiency, and uninterrupted growth. It’s a long-term strategy that offers liquidity without penalties, no credit checks, and the ability to preserve the death benefit for heirs even while using the cash value during your lifetime. However, it must be carefully structured to avoid turning the policy into a Modified Endowment Contract (MEC), which would remove the tax advantages.

What Is a Modified Endowment Contract (MEC)?

A Modified Endowment Contract (MEC) is a life insurance policy that has been overfunded beyond the limits defined by the IRS. While overfunding is an intentional and often powerful strategy, crossing the MEC line strips away one of the policy’s key benefits: tax-free access to cash value through loans.

What triggers MEC status?

The IRS uses something called the 7-pay test—a formula that limits how much premium can be paid into a policy within the first seven years. If you fund more than allowed, the policy becomes an MEC.

Why does this matter?

Once a policy becomes a MEC:

- Policy loans and withdrawals become taxable

- Penalties may apply for early withdrawals (before age 59½)

- The policy still functions as life insurance but loses key living benefits

This is why proper design—done with a broker who understands investment-focused structuring—is non-negotiable. A knowledgeable broker will work within IRS limits to maximize cash value contributions while preserving the tax advantages, making the most of your overfunded strategy without triggering an MEC.

So, What’s the Best Policy Type for Investment?

The best type of policy depends on your financial goals, time horizon, and comfort with risk. Here’s a quick comparison based on different use cases:

| Goal | Best Policy Type | Why |

| Predictable, conservative growth | Whole Life | Guarantees + dividends, structured for long-term control |

| Growth potential with safety | IUL | Market-linked upside with downside protection |

| Aggressive, high-risk growth | VUL | Direct market exposure, suitable for experienced investors |

Suppose you’re prioritizing liquidity, long-term tax benefits, and legacy planning. In that case, whole life or IUL—when properly overfunded—are typically the most effective for building cash value while maintaining flexibility.

Final Thoughts

When structured properly, permanent life insurance can offer far more than protection—it can serve as a powerful financial asset with built-in tax advantages, investment flexibility, and long-term wealth-building potential. Depending on the structure, policies like whole life, universal life, and even variable life can be tailored to support retirement income, finance major expenses, or act as a personal reserve of capital.

These types of policies stand apart from traditional investment plans by offering features like tax-deferred accumulation, penalty-free access through policy loans, and protection against market losses (in the case of indexed universal life). When designed intentionally, they become more than insurance products—they become integrated investment solutions.

That said, navigating policy fees, funding thresholds, and Modified Endowment Contract (MEC) rules requires experience. It’s also essential to determine whether life insurance is a suitable component of your broader financial strategy or if more traditional investment options like a 401(k) or Roth IRA may be more appropriate.

If you’re wondering whether a permanent insurance strategy is right for you, or if you’d like to explore how life insurance can complement your existing accounts and improve overall investment performance, I’d be happy to help.

I’m Albert Brown, a licensed life insurance broker serving all of Oregon. I specialize in designing policies that align with long-term goals—whether you’re building tax-free income, preserving wealth, or maximizing insurance cash for liquidity and legacy.

📞 Call me directly at 541-362-1455 to schedule a consultation.