Life insurance is a financial contract between a policyholder and an insurance company, where the company promises to pay a designated death benefit to named beneficiaries upon the policyholder’s death. In return, the policyholder pays regular premiums for the duration of the policy.

The primary goal of life insurance is to provide financial protection for loved ones in the event of the insured’s death. It can help cover lost income, funeral expenses, debt obligations, or future goals like college tuition or estate planning.

There are two major categories of life insurance policies: term life insurance and permanent life insurance. Within these, several subtypes offer tailored benefits, depending on your financial needs and personal situation.

Here are the main types of life insurance policies covered in this guide:

- Term Life Insurance – Temporary coverage with fixed or decreasing benefits

- Level Term Life Insurance

- Decreasing Term Life Insurance

- Renewable Term Life Insurance

- Convertible Term Life Insurance

- Permanent Life Insurance – Lifetime coverage with a savings or investment component

- Whole Life Insurance

- Universal Life Insurance

- Indexed Universal Life Insurance

- Guaranteed Universal Life Insurance

- Variable Life Insurance

- Final Expense Life Insurance – Low coverage amounts for funeral or burial costs

- Credit Life Insurance – Pays off a loan balance upon the insured’s death

- Group Life Insurance – Employer- or association-sponsored basic life coverage

Each of these insurance policies offers unique benefits, premiums, and purposes. The sections ahead will help you understand which type of life insurance may be best suited for your needs.

Term Life Insurance

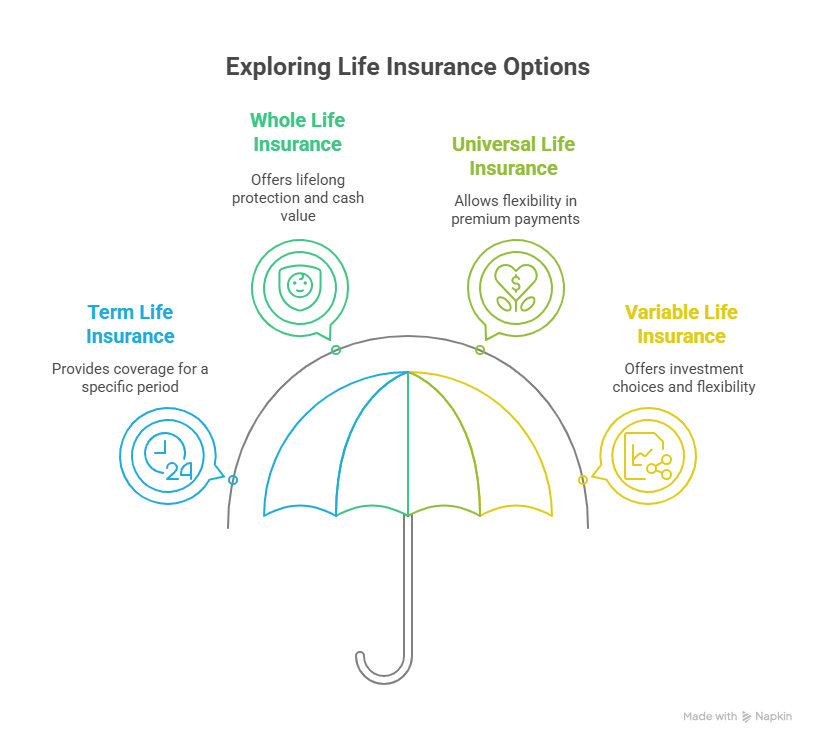

Term life insurance provides temporary coverage for a specific period—usually 10, 20, or 30 years. If the insured passes away during the term, the death benefit is paid to the beneficiaries. It’s a straightforward type of insurance policy with no cash value accumulation, making it one of the most affordable options for families and individuals looking for basic financial protection.

Level Term

Level term life is the most common form of term life insurance. The death benefit and premiums remain fixed throughout the policy term. This predictability makes budgeting easier and is ideal for those with long-term financial obligations, such as a mortgage or raising children.

The coverage amount is selected at the time of application and should reflect your financial responsibilities. Many individuals opt for level term policies during their peak earning years to provide consistent support for loved ones if the unexpected happens.

Who Should Consider Level Term Life Insurance

- Individuals with long-term financial obligations (e.g., mortgages, raising children)

- Families seeking consistent coverage and predictable premiums

- Anyone looking for a reliable, affordable life insurance option

Decreasing Term

Decreasing term life insurance offers a death benefit that reduces over time, typically aligning with the balance of a loan or mortgage. While premiums may remain the same, the declining coverage makes this type suitable for debts that decrease over time.

It’s often used in conjunction with a mortgage or other large loan to ensure that outstanding balances are covered without overpaying for insurance. This is a more specialized type of term insurance, and may not be ideal for long-term income replacement needs.

Renewable and Convertible Term

Some term life policies offer renewable or convertible features. A renewable term policy allows you to extend coverage at the end of the term without undergoing a medical exam, although the premium may increase based on your age.

A convertible term policy lets you transition into a permanent life plan—such as whole life insurance or universal life insurance—without proving insurability. These hybrid options are helpful for individuals who anticipate changing insurance needs or want future access to cash value options.

These options may be a good fit for:

- People who want flexible term insurance without long-term commitment

- Individuals concerned about losing coverage due to health changes

- Young professionals who want to start with affordable life insurance and convert later

- Anyone planning ahead for long-term financial goals or evolving family needs

- Those who want to preserve access to permanent life insurance without new underwriting

Pros and Cons of Term Insurance

Like all insurance policies, term life insurance comes with distinct advantages and limitations. Understanding these can help you determine whether term insurance is the right fit for your financial needs and long-term goals.

✅ Pros of Term Life Insurance

- Affordable premiums – One of the most budget-friendly types of life insurance, especially for younger or healthy individuals.

- Simple structure – Fixed coverage amounts, clear terms, and no investment components make it easy to understand.

- Customizable durations – Choose policy terms that align with major milestones, like paying off a mortgage or supporting children through college.

- High death benefit for the cost – You can often secure substantial coverage at a low premium, offering strong protection during critical life stages.

⚠️ Cons of Term Life Insurance

- No cash value accumulation – Unlike permanent life insurance, term life policies do not build cash value over time.

- Expires without value – If the policy term ends and the insured is still alive, the coverage ends and no benefit is paid.

- Rising costs with age – Renewing or reapplying later in life typically means higher premiums due to age and health factors.

- Limited use for estate or legacy planning – Term policies are designed for income replacement, not long-term wealth transfer.

In summary, term life insurance is ideal for those seeking straightforward, temporary life coverage to protect their loved ones during financially vulnerable years. However, if you want lifetime protection, cash value, or estate planning benefits, you may want to consider permanent life alternatives.

Permanent Life Insurance

Unlike term policies, permanent life insurance provides coverage for your entire life—as long as premiums are paid. These insurance policies include a guaranteed death benefit and often a cash value component that grows over time. These life policies are often used for legacy planning, wealth transfer, or as a supplemental financial asset in retirement strategies.

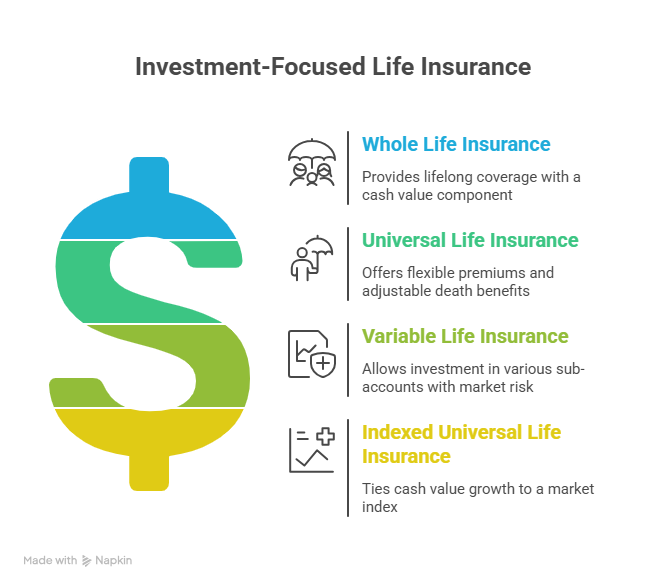

Whole Life Insurance

Whole life insurance is the most traditional type of permanent life insurance. It features fixed premiums, guaranteed coverage, and predictable cash value growth set by the insurance company.

Over time, the cash value accumulates tax-deferred and can be borrowed against. This makes it a conservative yet reliable choice for those who value stability and guarantees.

H4: Who Should Consider Whole Life Insurance

- Individuals seeking lifetime coverage with fixed costs

- Those who want to build long-term cash value

- People planning for estate taxes or intergenerational wealth transfer

Universal Life Insurance

Universal life insurance offers flexibility in both premium payments and death benefit amounts. The cash value grows at an interest rate that may fluctuate over time, often tied to the insurance company’s general account performance.

Policyholders can adjust how much and when they pay (within limits), making it more dynamic than whole life insurance.

Who Should Consider Universal Life Insurance

- People needing life insurance with adjustable payments

- Individuals with variable income who want coverage they can control

- Those seeking both protection and modest long-term financial growth

Variable Life Insurance

Variable life insurance allows policyholders to invest the cash value in a selection of sub-accounts that resemble mutual funds. The death benefit and cash value may rise or fall based on investment performance.

This type of policy offers greater upside potential—but also higher risk—than whole life or universal life products.

Who Should Consider Variable Life Insurance

- Individuals comfortable with market exposure and investment risk

- Those looking for greater financial growth potential in their life insurance

- People seeking permanent coverage with built-in investment choices

IULs

Indexed Universal Life Insurance (IUL) is a variation of universal life where the cash value is linked to a market index, such as the S&P 500. Unlike variable life insurance, you don’t directly invest in the market—your returns are tied to index performance, with both caps and floors applied to protect against losses.

Who Should Consider IULs

- Individuals wanting some market-linked growth without full risk exposure

- People seeking downside protection while still growing cash value

- Those who want flexible premiums and death benefit options

H3: Guaranteed Universal Life Insurance

Guaranteed universal life insurance is designed for affordability and lifetime protection without the focus on building cash value. Think of it as the middle ground between term life insurance and whole life insurance—permanent coverage at a lower cost.

These policies emphasize guaranteed death benefits and fixed premiums, making them ideal for predictable, long-term needs.

Who Should Consider Guaranteed Universal Life Insurance

- Individuals seeking permanent life insurance at a lower cost

- Those focused on death benefit security, not cash accumulation

- People wanting a simple, no-frills policy for estate or legacy planning

Final Expense Life Insurance

Final expense life insurance—also known as burial or funeral insurance—is designed to cover end-of-life costs such as funeral services, medical bills, or small debts. These policies typically offer smaller coverage amounts (e.g., $5,000 to $25,000) and are easy to qualify for, even for individuals with health issues.

This type of life insurance has fixed premiums, permanent coverage, and a guaranteed death benefit, making it a practical option for those with limited insurance needs.

Who Should Consider Final Expense Life Insurance

- Seniors who want to ease the financial burden on family members

- Individuals with health concerns who need guaranteed approval

- Those seeking a simple, low-cost insurance policy to handle final expenses

Credit Life Insurance

Credit life insurance is a specialized policy that pays off a specific loan—like a mortgage, auto loan, or personal debt—if the borrower passes away before the balance is paid in full. The death benefit goes directly to the lender, not to your beneficiaries.

While it offers peace of mind for borrowers, this type of life insurance is often more expensive than traditional options and may offer less flexibility.

Who Should Consider Credit Life Insurance

- Borrowers with large debts who don’t have traditional life insurance

- Individuals seeking automatic debt repayment upon death

- People who want to protect a co-signer or family from liability

Group Life Insurance

Group life insurance is typically offered through an employer or membership organization. These insurance policies are often low-cost or free to employees and require little to no medical underwriting.

However, group life plans usually provide limited coverage amounts and may not be portable if you leave the job. They work best as supplemental protection, not your sole policy.

Who Should Consider Group Life Insurance

- Employees looking to enhance their overall life insurance coverage

- Individuals who want free or low-cost insurance as part of their benefits

- Anyone who needs basic financial protection while exploring private options

Comparing the Main Types of Life Insurance

Choosing among different types of life insurance means balancing cost, duration, flexibility, and goals. Here’s a simplified comparison of key features:

| Type | Duration | Cash Value | Flexibility | Ideal For |

|---|---|---|---|---|

| Term Life | 10–30 years | ❌ | Moderate (convertible/renewable) | Income replacement, budget-conscious buyers |

| Whole Life | Lifetime | ✅ Guaranteed | Low | Estate planning, lifelong guarantees |

| Universal Life | Lifetime | ✅ Flexible | High | Adjustable needs, mid-to-high income earners |

| Variable Life | Lifetime | ✅ Market-based | High | Investment-savvy individuals |

| Indexed UL | Lifetime | ✅ Index-based | High | Growth with downside protection |

| Guaranteed UL | Lifetime | ❌ | Low | Low-cost lifetime coverage |

| Final Expense | Lifetime | ❌ | Low | Seniors, burial costs |

| Credit Life | Loan term | ❌ | Very low | Borrowers without traditional life insurance |

| Group Life | Employment term | ❌ | Low | Employees, temporary coverage needs |

H2: How to Choose the Right Life Insurance Policy

At Central Oregon Life Insurance, we understand that every household has different priorities when it comes to life insurance. Selecting the right policy involves more than just picking the lowest premium—it’s about aligning your financial goals, family needs, and personal situation.

Key questions to consider:

- Do you need temporary or permanent life insurance?

- Is cash value important for your savings or retirement goals?

- How much coverage do you need to protect your loved ones?

- What can you afford in monthly or annual premiums?

Working with a licensed professional—like our agents at Central Oregon Life Insurance—can help you tailor a solution that supports your present and future needs, no matter the types of life insurance you’re considering.

Life Insurance FAQs

Can I have more than one life insurance policy?

Yes. Many people carry multiple insurance policies for different needs—such as a term life policy for income replacement and a whole life policy for legacy planning.

What happens if I outlive my term policy?

If you outlive your term life insurance, the coverage ends and no death benefit is paid. However, some term insurance policies are renewable or convertible to permanent life insurance.

Is life insurance taxable?

In most cases, life insurance death benefits are not considered taxable income. However, exceptions apply if the policy is part of a business agreement or estate plan.

Can I switch from term to permanent insurance?

Yes—if your term policy is convertible. You can transition to a permanent life product without a medical exam, often within a specific timeframe.

Choosing Confidence with Central Oregon Life Insurance

Understanding the types of life insurance available is key to protecting your family, your income, and your future. Whether you need the simplicity of term life, the lasting value of whole life insurance, or the flexible features of universal life insurance, the right policy provides peace of mind.

At Central Oregon Life Insurance, we’re here to guide you through every step—from selecting the right coverage amount to managing your premiums. Our goal is to offer trusted advice, tailored solutions, and lifelong support.